Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC]

![Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC] Simplifying The Market](https://img.chime.me/image/fs/chimeblog/20240427/16/original_12f3ca89-27fb-426b-ac2a-56bf06b16cce.png)

Some Highlights

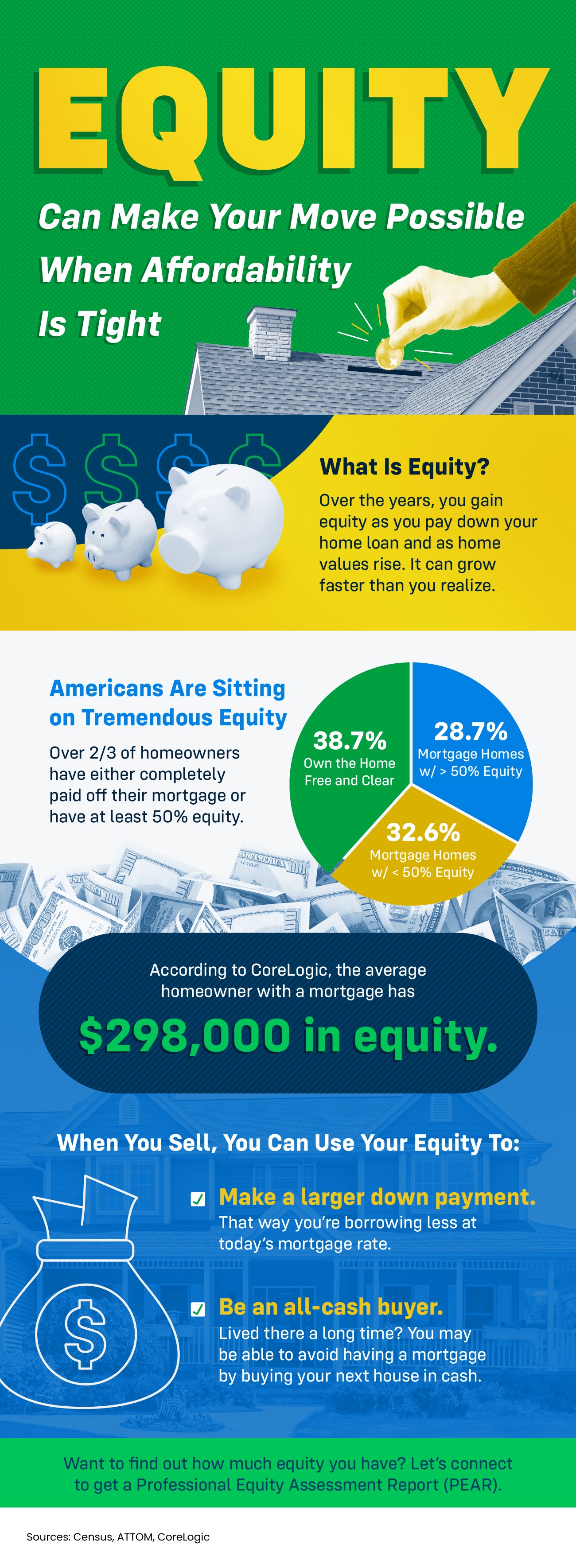

- Did you know the equity you have in your current house can help make your move possible?

- Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer.

- The typical homeowner has $298,000 in equity. If you want to find out how much you have, connect with a local real estate agent for a Professional Equity Assessment Report.

Categories

Recent Posts

More Buyers Are Planning To Move in 2026. Here’s How To Get Ready.

Not Sure If You’re Ready To Buy a Home? Ask Yourself These 5 Questions.

Reasons To Be Optimistic About the 2026 Housing Market

Turning a House Into a Home: The Benefits You Can Actually Feel

Your House Didn’t Sell. What Now?

Headlines Have You Worried about Your Home’s Value? Read This.

Is January the Best Time To Buy a Home?

Is Buyer Demand Picking Back Up? What Sellers Should Know.

How To Stretch Your Options, Not Your Budget

Your Equity Could Change Everything About Your Next Move

Leave a Reply